A common question to a traditionally

older retirement investment.

What is an annuity? Why are annuities popular again? Two popular google searches that come up relatively quickly. But while most of the answers are somewhat high level or, on the opposite end, murky and confusing it’s important to understand what they are and what they aren’t before hopping on the bandwagon and making a purchase that will affect your overall retirement plan.

Having traditionally been known as something only older investors nearing retirement age would consider, annuities have been gaining more popularity over time. Why? Many younger investors are looking for a way to diversify their portfolios. So when something like stock market volatility hits they’re better able to weather the proverbial storm. This is where annuities come in.

While they come in many flavors, annuities share the defining characteristic of providing guaranteed income. It’s this particular feature that proves especially important to individuals nearing retirement, as it helps protect them from the possibility of outliving their savings. There are two overarching camps that annuities fall into, immediate and deferred. Understanding how each of these works can help you to decide which annuity works best for you or if it fits into your retirement strategy.

A Tough Decision: Income Now or Later?

Immediate annuities or single premium immediate annuities (SIPA) are funded by a single lump sum and guarantee you monthly payments. This is what you would choose if you wanted money right away. This is something you might choose to purchase right as you get ready to re ady to retire. According to Annuity.org, “an immediate annuity skips the accumulation phase and begins paying out income either immediately or within a year after you have purchased it.” If a SIPA is not what you’re looking for, other immediate annuities include: fixed immediate annuities, inflation-indexed annuity, as well as a fixed immediate annuity.

Types of Annuities

Fixed annuity: A fixed annuity pays a guaranteed rate of interest, like a certificate of deposit (CD) at a bank. When you purchase a fixed annuity, the insurance company agrees to pay you a set amount of interest each year. At the end of the term, you receive your original investment plus any interest that has accumulated.

Inflation-indexed annuity: An inflation-indexed annuity pays interest that is linked to an index, such as the Consumer Price Index (CPI) or the cost of living in your area. This type of annuity is designed to keep pace with inflation so your payments maintain their purchasing power over time.

Fixed immediate annuity: A fixed immediate annuity pays guaranteed income for a set period of time, such as 10 or 20 years. Once the term expires, your payments stop and you do not receive any interest.

Deferred annuities are quite different from their immediate counterparts. These annuities are tax-deferred and guarantee lifetime income.Unlike immediate annuities, deferred annuities begin on a date you specify and actually provide you with more income. This is because they allow money to accumulate over time. There are also different types of deferred annuities: single premium deferred annuity, flexible premium deferred annuity, fixed rate annuity, etc.

Single premium deferred annuity: A single premium deferred annuity is purchased with a lump sum payment. Your money grows tax-deferred, and you can choose to receive income at any time after the policy matures.

Flexible premium deferred annuity: A flexible premium deferred annuity allows you to make periodic payments, such as monthly or yearly.

Fixed-rate annuity: A fixed-rate annuity pays a guaranteed interest rate for the term of the annuity. The longer the term, the higher the interest rate.

Kaizen Wealth Group – Annuities as an option for income

Combining the Best of Both Worlds

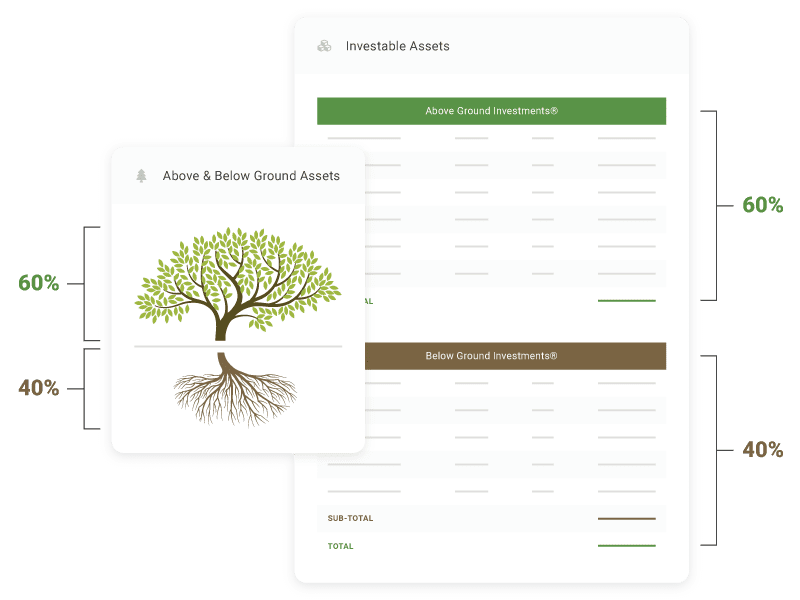

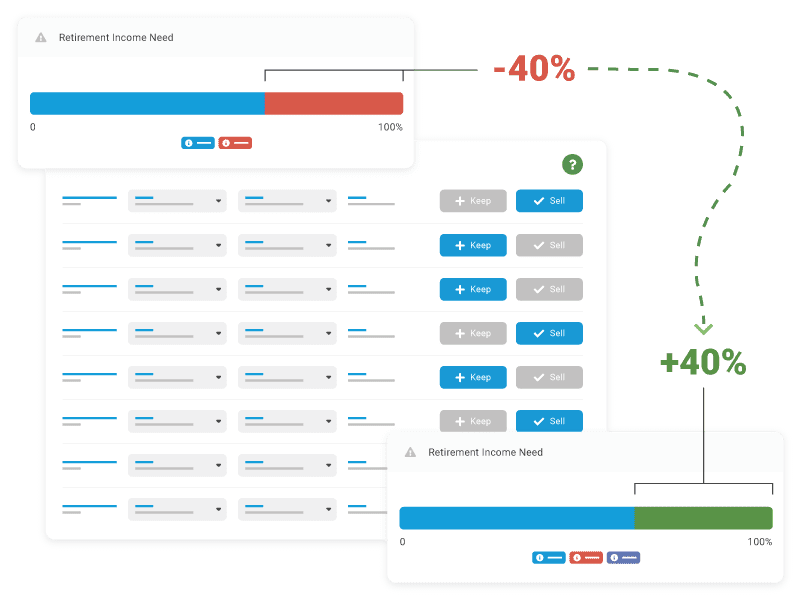

There is such a thing as a split-annuity strategy. A split-annuity strategy is an investment technique that mixes an immediate annuity with a deferred annuity in order to provide income during retirement while still allowing for the possibility of estate growth. This technique is often used by individuals that are nearing retirement age and want to ensure they have a steady stream of income while also leaving room for their investments to grow.

Regardless of the camp you fall into, as with any investment vehicle, carefully weigh the pros and cons before deciding to allocate a portion of assets to an annuity.

3 Benefits of Choosing to Invest in Annuities

- Guaranteed income. One of the greatest benefits of an annuity is guaranteed income. This is especially true for those seeking a steady, passive income for the duration of their retirement. Many retirees know they need to depend on more than social security benefits. Having the cushion of an annuity along with other traditional assets can help alleviate every day life expenses after retirement.

- Pre-tax contributions. Annuities also offer the ability to contribute on a pre-tax basis, deferring the taxes owed until you begin to receive payments. Unlike your traditional 401 (k) or an Independent Retirement Account (IRA)there is no annual contribution limit. This allows you to put away more money and can be a particularly nice perk for those closest to retiring. What’s more, these contributions can grow significantly between the time you invest in the annuity and its maturation.

- Guaranteed Rates. While some annuities do fluctuate with the stock market, others offer fixed rate options. This can be especially appealing when you’re looking for a way to weather a volatile stock market. However, it’s important to understand contract language. Some annuities may have a fixed rate for a fixed amount of years before changing to meet current market rates.

3 Cons of Choosing an Annuity

- Associated costs. This might be the most important part for individuals to remember. Annuities can come with a boat load of fees. Commissions for example can vary depending upon the type of annuity you choose. A fixed index annuity commission can be as much as 8% while a Multi-Year Guaranteed Annuity (MYGA) can charge as little as 1%. Additional fees can include administrative, mortality, as well as investment and management fees. Should you withdraw your money prematurely, there are surrender charges which can also vary. If you decide on an annuity be sure to dig into the contract and make sure you understand all of the terms before you sign on the dotted line.

- Other Competitive Options. Younger people who have a longer timeline would benefit from a more aggressive retirement strategy. Annuities don’t exactly meet this criteria.Some people also choose to invest in bonds over annuities since they are easier to buy and can have higher yields.

- Problems Keeping Pace With Inflation. While annuities can provide you with regular income as a retiree, they can lose their purchase power over time. And when you lose purchase power it can impact quality of life. For example, say you receive $3,500 a month in annuity payments. Suddenly, inflation rears its ugly head and increases to something like 10%. That $3,500 is now really $2,700. While some annuities can offer protection from this, others do not. Features differ with each product.

Kaizen Wealth Group – Annuities can transfer to beneficiaries

Do Beneficiaries Benefit From Annuities?

If you’re wondering how an annuity can benefit your loved ones, the good news is annuities can be willed to your beneficiaries. When an annuitant passes away their loved ones can choose how they want to receive payouts. There are three options: lump sum distribution (receives remaining balance in one payment), Nonqualified-Stretch Provision (receive payments based on his/her life expectancy), or a Five-Year Rule (withdrawal incremental amounts during during a five year time span or withdrawal the entire amount after the fifth year.)

Know When to Seek Guidance From a Financial Advisor

Annuities are extremely complex. While there are several different types, with their own pros and cons, it’s often difficult to determine what best suits your needs and expectations. That’s where a financial advisor or a wealth manager can help. Taking the time to work with someone in your area who knows the ins and outs of investing and planning for retirement can be in your best interest. Not only do they know steps you can take that may be more advantageous to your overall financial plan, but they can also answer your questions. Often times questions about annuities also come along with questions like how much savings do I need to retire on time or how has COVID impacted my retirement plan? When you have a reputable wealth management group working for you they will offer insurance and tax solutions that can help to answer these types of questions and may also suggest a comprehensive financial overview. If you have questions about annuities or would like to learn more about the health of your financial plan, contact us today.