5 Key Tricks to Retirement Planning During Uncertain Times

It’s no secret that retirement planning can be difficult. Add to that a volatile stock market or inflation and suddenly you’re not sure you’re as ready as you thought you were. Maybe you haven’t even had a chance to begin planning for retirement. Whichever path you’re on, chances are the questions are stacking up: How can you make sure your retirement savings will be enough to last? How has COVID impacted retirement planning? What is an annuity? How do I start planning? The list can go on, but where are the answers?

The first step is to take a breath and remember, that it’s okay to get back to the basics. If you’re an individual who hasn’t started planning for retirement, now is as good a time as any. Whether it’s a bull market or a bear market, whether you’re young or old, having a retirement plan is the first step.

Planning for Retirement During Uncertain Times

Understanding the Retirement Planning Basics

As anyone who has ever tried retirement planning knows it can be a daunting task. There are so many variables to consider, from Social Security benefits and pensions to investment portfolios and inflation rates. And that’s not even taking into account the possibility of life expectancy changes or long-term care needs. Retirement planning is complex, and it can be difficult to know where to start.

For most people, the best approach is to start with the basics: save for retirement. Seems simple right? Unfortunately, 1 in 4 Americans have no retirement savings. Couple that with something like inflation, a global pandemic, and high unemployment, it makes it that much harder to save for the future. For those who are able to work toward a retirement savings goal, there are options. Even during uncertain times. While there’s no one-size-fits-all answer for how much to save, experts generally recommend setting aside 10-15% of your income for retirement.

That likely sounds like a lot, but there are contributing factors you should keep in mind. The younger you start saving the better off you are. It’s one of those instances where time is on your side. For example, say you begin investing $100 a month at the age of 26. When you reach 66, you’d have a retirement balance of more than $640,000.

However, if you’re already behind on retirement savings, don’t despair. Even small changes can make a big difference over time. For example, increasing your savings rate by just 1% can add up to thousands of extra dollars over the course of your career.

A Recession Looming

If all the talk about a looming recession has you worried, you’re not alone. In fact, one survey from Empower Retirement and Personal Capital recently reported as many as 74% of U.S. consumers are concerned about a possible recession. As some Americans approach retirement age it becomes especially worrisome. Do I have enough money saved for retirement? How do I account for inflation during retirement? What impact has the stock market had on my retirement portfolio? The questions go on, but the key thing to remember is to not make any knee-jerk reactions when it comes to long-term retirement planning or goals.

For many, a recession or a bear market can be an opportunity. How so? Investors will tell you it’s an opportunity to buy stocks and bonds at a lower rate. While it may be bumpy for a while, adding them to your portfolio is the key. When the economy and the stock market improve you’ll have assets that will be worth more than when you bought them.

5 Ways to Plan For Retirement

If you’re ready to get started planning for retirement despite uncertain times we have five key tricks to help. These financial tips will help you take the first steps to get on track and ensure your retirement years are happy and stress-free.

1 – Establish Retirement Goals

Start by evaluating your retirement goals. Do you want to retire as soon as possible? Or do you want to wait until later in life?

Some retirement goals may include:

- Having a retirement nest egg of a certain dollar amount.

- Maintaining a certain lifestyle in retirement.

- Who will help you make financial decisions as time goes on?

- Leaving an inheritance for your children or grandchildren.

- Traveling during retirement.

- Working part-time during retirement.

Regardless of when you plan on retiring, it’s important to have a retirement goal in mind. Answering these questions and more will help you determine how much money you need to save each month. It will also help you identify if your current financial plan will help you meet your long-term retirement goals as well as help you determine how you want to spend your golden years.

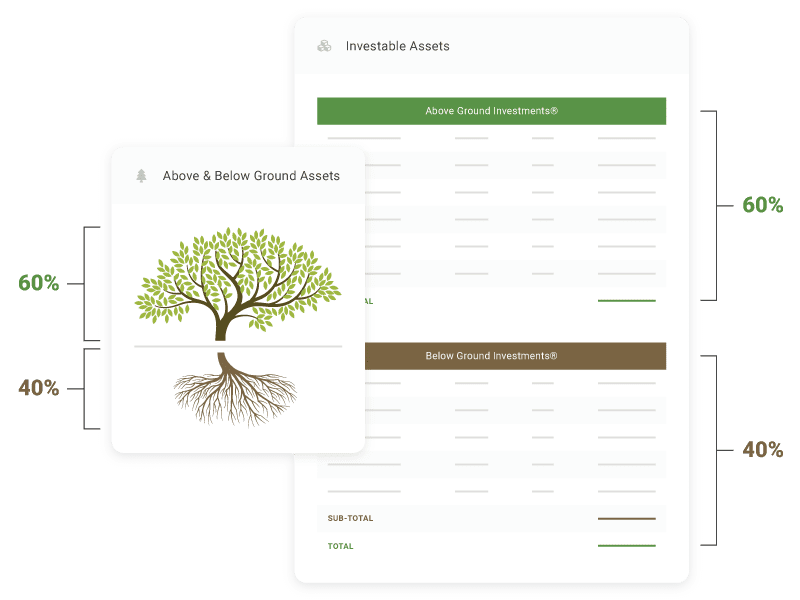

2 – Increase Your Investment Portfolio

Increase your investment portfolio without taking on too much risk. Sounds easy right? All jokes aside, a retirement portfolio that’s heavy on one thing and light on others leave you exposed and your future at risk. For example, stocks may be volatile, but they have the potential to offer higher returns than a portfolio that contains mostly bonds. Cryptocurrency is also becoming more and more of an asset people inquire about adding to their portfolio. Like stocks, cryptocurrency can also be volatile. That being said, you don’t want to take on more risk than you’re comfortable with.

Fidelity, for example, recommends individuals diversify across stocks by market capitalization (small, mid, and large caps), sectors, and geography. You can also diversify your portfolio with bonds, cash, real estate, and other assets. When you diversify and have more assets under your umbrella, if one thing suffers you have other parts will either be growing or not impacted as much.

3 – Account for Inflation

No matter what is going on in the world, accounting for inflation during retirement planning is a critical step. It seems like a vague step and you might not be sure just how to do so. When planning, there’s a general consensus on using an annual 3 percent inflation rate when planning for retirement. In retirement, purchasing power is everything. When inflation occurs, it can have a major impact on your retirement savings as well as your overall purchase power. When your money is impacted by inflation your retirement savings will decrease over time if inflation goes up and it’s unaccounted for during planning. For example, “pensioners receive a fixed 5 percent yearly increase to their pension. When inflation is higher than 5 percent, a pensioner’s purchasing power falls.” You can make $3,000 a month, but when inflation rates are high, say 9% you’re really only making $2,730. That can be a significant amount of money for people who are on a fixed budget. Find our 3 ways to account for inflation here.

4 – Cut Back on Spending. Increase Savings.

One of the best ways to combat retirement uncertainty is to simply save more money. So what are some steps you can take to put more money in your retirement savings account? One very important one is to cut back on your spending. When you cut back on your spending put that money toward your retirement savings. This will help you build up your retirement nest egg so you have a cushion in case the stock market takes a dip or inflation rises. Another step you can take is to make a budget. This might seem offputting, but it works. Some advisors recommend the 50-30-20 rule. This means 50% to your needs, 30% to your wants, and 20% to savings. Putting that extra toward a retirement savings account or another investment can help put your on the right track for retirement.

5 – Have a Good Investment Strategy

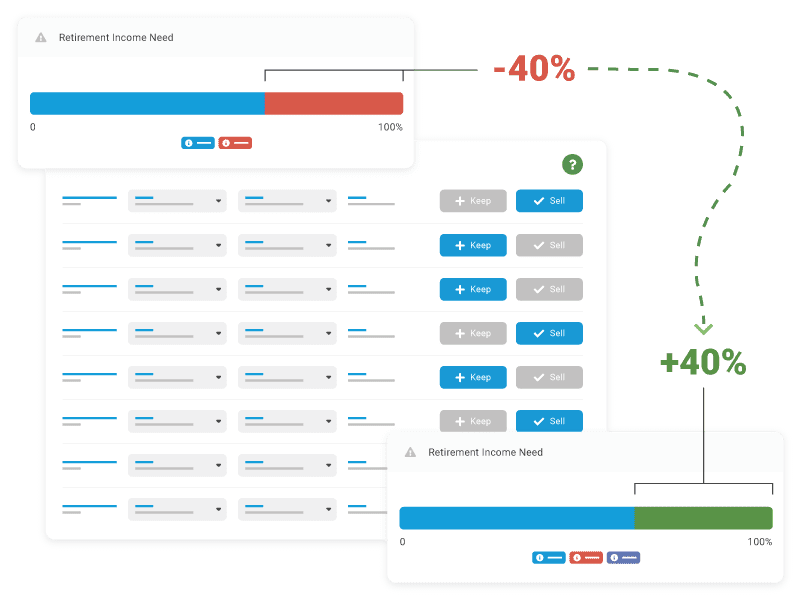

There’s no one-size-fits-all investment strategy, but there are some general principles that can help you create a good investment strategy for your retirement account. An investment strategy, for example, would be to implement the steps we’ve outlined in this article, but they can also be tailored to meet your needs. Everyone’s retirement needs are different. For investors who are looking to save more or are approaching retirement quickly, theyir strategy would be different. They might see a change in their spending, minimize as much of their debt as possible, and calculate their medical costs. Planning for long-term care and ensuring you have the proper insurance, as well as a good tax strategy in place are all things you can consider no matter where you’re at in the retirement planning process. When you develop a solid investment strategy it can get you much closer to helping you reach your financial goals.

Other Things to Consider When Planning

The Impact of Inflation on Retirement Planning

A looming recession isn’t the only thing people are worried about when it comes to their individual retirement accounts. Inflation rates hit a 40-year high, reaching 9.1%, in August of 2022. This has had a major impact on retirement plans and retirement savings for many. It not only costs retirees their purchasing power but it’s cut into the savings of many. Bloomberg.com reported: “Rather than cooling down, inflation is heating up,” Sal Guatieri, senior economist at BMO Capital Markets, said in a note. “While a pullback in gasoline costs in July and reported retail discounting will help tamp down the flames, the broad pressure in the core rate, led by plenty of inertia in rents, suggests inflation may not peak for a while and might remain stubbornly high for longer than anticipated.”

A Volatile Stock Market

When it comes to retirement planning, the stock market can be a bit of a mixed bag. On the one hand, stocks offer the potential for high returns that can help to grow your retirement nest egg. On the other hand, stocks can also be quite volatile, and a sudden market downturn can take a serious toll on your retirement savings. As a result, retirement planning in a volatile stock market can be a bit of a balancing act.

On the plus side, retirement planning in a volatile stock market can force you to take a more holistic approach. Of course, it can also be quite stressful. Watching your retirement savings go up and down can be nerve-wracking, and it can be tempting to make rash decisions in an attempt to protect your savings. However, it’s important to remember that retirement planning is a long-term process, and short-term market fluctuations shouldn’t derail your plans.

What About Crypto?

Cryptocurrency also has seen its fair share of ups and downs. Like its cousin, the stock market, the crypto markets around the globe have been affected by the likes of a global pandemic, supply chain shortages, global warfare, and inflation. Since November 2021, the crypto market has dropped 60%—drastically falling from $3 trillion to less than $1 trillion, as of June 2022. Experts say the market has entered crypto winter, one it has not seen the likes of since December 2020. While many continue to invest in various forms of cryptocurrency, it’s wise to proceed with caution.

Have a Financial Analysis Conducted.

When in doubt, have a financial analysis conducted. These can be especially helpful in determining the health of your current financial plan and how to get your retirement plan where you’d like to be. Be sure to work with a certified financial planner who can help answer your questions or concerns and guide you toward your retirement goals. Wealth Management firms, like Kaizen Wealth, offer these types of services. Schedule a financial review with us today.